Service functions

-

Download center

-

Add to My Report

-

My Report (0)

-

Print this Page

-

Download in PDF

-

Share

-

Feedback

-

Interactive analysis

-

Browsing history

-

Offline version

-

Company in soc.networks

-

Compared to 2011

-

Popular pages

-

Company on the map

-

Compact view

| Enter e-mail recipient * | Your e-mail * | Comment : | |

| * required fields | |||

Review of Macroeconomic Market Indicators Influencing

the Transportation Market

Scope of JSC “RZD” activities traditionally depend on macroeconomic trends in Russia and, in the context of intensified integration, the state of the global economy.

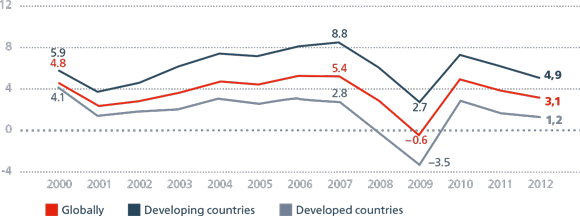

According to estimates of the IMF, in 2012, the global economy grew by 3.1%. The global economy growth rate has significantly slowed down even compared to the poor performance seen in 2011 (+3.9%).

Global GDP growth forecasts gradually decreased during 2012 in line with worsening expectations. In April 2012, the IMF predicted annual growth of 3.5%; by October 2012 this had fallen to 3.3%.

The OECD also reduced its GDP growth forecasts — from 3.4% in May 2012 to 2.9% in November 2012. Both developed and developing economies are expected to slow down. The Eurozone has not yet successfully addressed its debt situation. China, whose economy has grown for nearly two decades in a row, has built up a number of unresolved issues and faced a decline in demand from developed countries. A wave of economic problems has swept across India, Central and Eastern Europe.

- Major factors affecting the market positions of JSC “RZD”

- State policy with regard to the Company’s service tariffs

- Freight turnover growth potential

- Availability of infrastructure possibilities and rolling stock to accommodate transportation needs

- Effective use of the infrastructure and productivity of the rolling stock

- Dynamics and level of Holding Company’s competitiveness with other market players (intraspecific and interspecific competition)

The decrease in the global trade rate was even more notable — from 6.0% in 2011 to 2.5% at the end of 2012, mainly due to the worsening of the debt crisis in Eurozone and the deceleration in China’s GDP growth.

The most problematic region in terms of economic development was the Eurozone which was in recession, with many of its member countries facing a national debt crisis. In 2012, the Eurozone GDP decreased 0.6% with the decline intensifying each quarter. Industrial output year-on-year also decreased throughout the year with the worst decline recorded in Q4. At the year-end, industrial output in the Eurozone decreased by 2.4% (versus 2011) with the unemployment rate increasing 1 p.p. to reach 11.8%.

In China, the rate of economic growth at the year-end decreased to +7.8% (versus +9.3% in 2011) — the lowest rate in 13 years. This was accompanied by deteriorating trends for China’s foreign trade and a decelerated growth for both imports and exports, which adversely affected the economies of many countries around the world, including Russia, which is China’s largest trade partner. In 2012, Chinese exports grew 7.9% year-on-year versus 20.3% in 2011 and imports grew 4.3% versus 24.9%.

The global economic structure is gradually evolving: the direction of global commodity flows is changing and traditional “centers of power” are being displaced.

GDP GROWTH RATES GLOBALLY, IN DEVELOPED AND DEVELOPING COUNTRIES IN

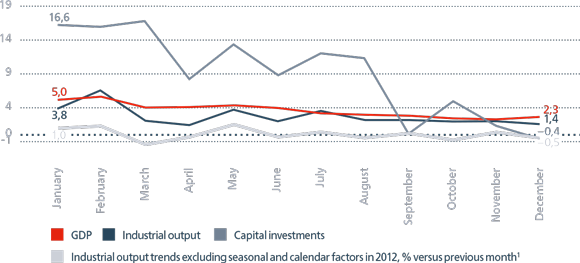

GLOBAL GDP, INDUSTRIAL OUTPUT AND CAPITAL INVESTMENT GROWTH RATE IN 2012, VERSUS THE SAME PERIOD OF 2011

GDP in Russia: GDP growth rate is slowing down

In the first half of 2012, the Russian economy was relatively stable, but in the second half, the trend towards decelerated growth against the most critical macroeconomic indicators became significantly stronger.

At the end of 2012, GDP increased 3.4% (versus 4.3% in 2011). GDP annual growth on a current basis amounted to RUR 62.6 trn. According to experts, increase in domestic demand was the main economic growth driver in Russia in 2012.

Despite the decelerated growth rate of the global economy, Russian exports and imports reached record levels in 2012. However their growth rate decreased considerably: exports increased 2.4% (versus 31.3% in 2011) and imports increased 5.4% (versus 29.7% in 2011).

The rate of economic growth was adversely affected by poor harvests: in particular, drought conditions led to a much lower grain yield against a very favorable yield in 2011. Overall, the volume of agricultural produce decreased by 4.7% against an increase of 23% in 2011.

Gain in industrial output amounted to only 2.6% versus 4.7% in the previous year. In December 2012, this figure was at its lowest (+1.4% year-on-year). Independent experts also spoke about the exacerbation of negative trends in industrial production. The Institute of Natural Monopolies (INM) noted an increased gap between demand and production: INM-production ratio increased 3% during the year, while INMdemand ratio increased by just 0.4%.

With demand for industrial products slowing down, businesses were reluctant to increase investments in production capacity. Increases in capital investment in 2012 amounted to 6.6% versus 1.8% in 2011. In December 2012, capital investments decreased by 0.4% yearon- year having reached an annual low. Conversely, in early 2012, the growth rate had exceeded 16%.

In 2013, Russian Ministry of Economic Development expects a relatively low rate of economic growth: +2.4% (according to a forecast made in April 2013).

Risks of significant deceleration of economic growth are predicted by renowned international organizations. In June 2013, the IMF downscaled Russian GDP growth forecast for the current year — from 3.4% to 2.5%. The World Bank also downscaled its forecast to a new GDP growth level of 2.3%. Decline in the Russian GDP growth rate is expected due to decreased external demand and a fall in global oil prices, Russia’s main export commodity.

According to the Central Dispatching Department of Fuel Energy Complex, oil exports from Russia to “far-abroad” countries decreased by 2% year-on-year in physical terms between January—May 2013, while the average price of Russian Urals oil decreased by 7% to USD 107.2 per barrel. Risks of further falls in global oil prices remain.

Decreased exports from Russia reduced foreign currency earnings of exporters, which brings about an elevated inflation risk because of the rise in costs of imports, which may adversely affect the stability of financial markets.

JSC “RZD” risks increase in the event of significant deterioration of Russian GRP trends

Global economy uncertainty and unstable economic trends in Russia pose a risk of a decelerated rate of growth in the volume of freight railway transportation or, in the event of a significant deterioration of the economic situation, its decrease, which, in turn, may adversely affect the income of JSC “RZD”.

Address of the President

Address of the President

175th Anniversary of Russian Railways

175th Anniversary of Russian Railways

Analysis

Analysis

Save Key Indicators to XLS

Save Key Indicators to XLS

Transport Development Strategy

Transport Development Strategy

Investment Activity

Investment Activity

Download Chapter Financial and Economic Performance

Download Chapter Financial and Economic Performance

Rating

Rating

Loan Portfolio

Loan Portfolio

Management System

Management System

Governing Structure Of JSC Russian Railways

Governing Structure Of JSC Russian Railways

Personnel management

Personnel management

Housing policy

Housing policy