Service functions

-

Download center

-

Add to My Report

-

My Report (0)

-

Print this Page

-

Download in PDF

-

Share

-

Feedback

-

Interactive analysis

-

Browsing history

-

Offline version

-

Company in soc.networks

-

Watch report 2011

-

Popular pages

-

Company on the map

-

Compact view

| Enter e-mail recipient * | Your e-mail * | Comment : | |

| * required fields | |||

Loading Structure by Main Freight Types

The Economic activities of JSC “RZD” as a bulk cargo carrier largely depend on the market situation and trends in key freightgenerating Russian and global industries, such as oil, coal and wood, ferrous industry, construction materials and production of mineral fertilizers.

A characteristic trend in recent years is the active growth in coal and oil cargo loading — freight which has the longest transportation distance.

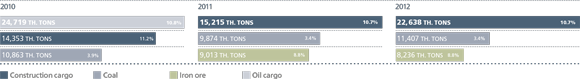

In 2012, 1,271.9 mln tons of freight (3,475.0 th. tons a day) were loaded on the railway network, which is 30.3 mln tons or 2.4% higher than in 2011.

Loading structure

| Low-incom | Mid-income | High-income |

- Coal

- Mineral construction materials

- Timber cargo

- Iron ores

Increase in the loading of first class freight amounted to 28.3 mln tons or 3.9%. Construction cargo (+ 14.4%), industrial commodities and moulding materials (+5.2% for both freight types) and coal (+3.9%) accounted for the largest increases in loading volumes.

- Oil and oil products

- Chemical and mineral fertilizers

- Grain and ground products

- Sugar

- Cast iron

Loading of second class freight exceeded the level of 2011 by 5.7 mln tons or 1.7%.

Loading of oil and oil products (+3.3%) and grain (+6.0%) also increased. At the same time, loading of sugar (−24.2%), ground products (−20.2%), chemical and mineral fertilizers (−3.1%) decreased.

Pre-crisis volumes of loading for oil and oil products and cakes were achieved.

- Non-ferrous metals

- Acids and oxides

- Machinery and equipment (apart from agricultural)

- Vehicles and their parts

- Alcoholic beverages

- Ferrous rolled stock

- Iron-and-steel scrap

Third class freight loading decreased: −3.7 mln tons or −2.3% year-on-year.

This negative trend is mainly due to a reduction in the loading of iron-andsteel scrap (−10.7%).

At the same time, container freight loading increased (+2.7%). Containers in the network load account for 1.6%, and in third class freight loading for 13.0%.

The pre-crisis level was exceeded only with regard to container freight loading.

Low-income freight accounted for the largest contribution to the loading increase in 2012.

The highest loading increase in 2012 was seen in:

- construction cargo;

- coal;

- oil and oil products.

As a whole, loading grew dynamically in Q1 of 2012, but this growth slowed down in Q2-3, due to a stagnation in industrial production. Loading declined in Q4.

FREIGHT WITH MAXIMUM LOAD INCREASE, TH. TONS

Freight with high load increase

| Construction materials | Coal | Oil and oil products |

Construction materials

The increase in construction freight loading compared to 2011 was 14.4% or +22.6 mln tons.

This high figure is due to increased financial support received by the construction industry, specifically, road construction, and the implementation of large infrastructure projects (2014 Olympics, 2013 Student Games, etc.).

Inert and construction materials are characterized by a regional distribution of supply. In addition, in 2012 industrial production and supply volumes grew at a high pace, as a result of a growth in demand on the Russian market, decreased exports and increased imports of non-ore materials, cement and finishing materials. Cement production and consumption volume last year was at its highest since the post-crisis period. Future market trends will depend on the implementation of federal and regional target programs and the development of house building.

The ferrous industry is extremely sensitive to the performance of external markets and, in 2012, global demand from major metal consuming industries decreased. On the home market, signs of a slow down in growth became clear by the end of Q3 of 2012.

At the year-end, an increase in supply from direct orders (i.e. bypassing the metal wholesale chain) to the construction industry, fuel and energy complex and railway machine building enterprises became evident. The situation in one of the critical industry segments of the domestic ferrous industry — steel pipe manufacture — significantly improved in Q4 of 2012 (following a slump in the first half of 2012). At the same time, there was a dramatic decline in supplies to the Russian ship, agricultural machine building and automotive industries. The decrease in domestic supplies of ferrous metals was partially made up for by increased imports of building metal products.

Uncertain outlooks for the Russian and global ferrous metal markets resulted in a decline in demand for raw metals: commercial-grade iron ore, iron-ore concentrate, openhearth pig iron, ferrous scrap, coke and a number of large industry-wide investment projects were either suspended or delayed. This resulted in a decelerated growth rate in freight railway transportation of ferrous metal. The transportation of metal products and raw materials was also exposed to stronger interspecific competition from water and road transport.

Nevertheless, a resumption of positive growth rates for metal freight railway transportation will be supported by:

- Increase in the domestic consumption of ferrous metals by pipeline transport. Considering that Gazprom is increasing its purchase of largediameter pipes (LDP) threefold in 2013, the volume of domestic consumption of LDP is likely to return to the level of 2011 after a sharp decline in 2012.

- Further implementation of large construction projects mainly funded by the federal budget and driving demand for metal products inside the country, including construction projects for the Olympics, Student Games and the World Football Cup in 2018.

Coal

In 2012, the increase in coal loading was 3.9% or 11.4 mln tons. Transportation volume in the domestic market decreased by 1.9%. Export loading increased by 13.3%, destined mainly to Japan, Great Britain, Turkey, Korea and China. Coal export growth rates significantly exceeded its production performance. In 2012, the share of exports of the total volume of coal produced in Russia reached 36% (+4 p.p.).

The decline in the volume of domestic Russian supply of coal products is the result of a lower demand for baking coal and coke from Russian ironworks and a relatively low demand for power station coal from domestic housing and communal businesses and utilities due to significant volumes of solid fuel stock in storage accumulated by them in late 2011.

A stronger focus on exports by the coal industry brings about additional risks for coal production in Russia and, correspondingly, railway transportation of these products:

- Due to the significant increase in coal exports from the US, Columbia, Mongolia, Indonesia;

- Possible slow down in growth rate of coal consumption in Europe and China in the mid term;

- High capital intensity and long periods of development of new coal deposits in inaccessible regions of Eastern Siberia and the Far East with a deteriorating investment climate in Russia and globally;

- Enhanced coal benefication capacities.

Oil and oil products

In 2012, the increase in oil cargo loading was 8.2 mln tons (+3.3% in 2011). The increase in the domestic Russian market was 3.6%, and in exports +3.0%.

Increase in the transportation volume is due to the commissioning of new capacity. In 2012 a new oil refinery of JSC “TANECO” at Kuibyshev Railway was launched; the volume of transportation associated with this business amounted to 4.5 mln tons. Following the commissioning of new capacity for oil cargo transshipment in the port of Ust-Luga, port loading also increased (+5.9 mln tons).

Major risks to JSC “RZD” as an oil cargo carrier are related to a significant deceleration of oil production in Russia and the fast growth of competing means of transport, such as main oil pipelines.

In December 2012, two years ahead of the schedule, the second phase of the “Eastern Siberia — Pacific” (ESP) oil pipeline construction was completed and in 2013, JSC “Transneft” intends to stop using rail transport on this route.

Oil supplies by rail transport due to ESP commissioning are expected to decrease by some

Additional risks include the increasing complexities faced by the oil industry. New large oil production project decisions have been delayed and existing fields have been largely depleted. Drilling site equipment, main oil pipelines and oil refineries need upgrading. Development of new fields in inaccessible areas (including on the continental shelf) require significant funds that often exceed current investment and processing capacities of the industry.

The ongoing upgrading of oil refining capacities is mainly aimed to bring fuel quality improvements in line with new technical regulations. Therefore, this will not result in a considerable growth in the supply of oil products, although their product mix may change with an increased output of light fuels.

At the same time, positive factors and trends that contributed to an increase in the railway transportation of oil cargo in 2012 are expected to provide growth in the medium term:

- In 2012, trends of railway supplies were positively affected by the steady growth in production and shipment of oil products, which account for a significant portion in the oil cargo loading structure of the Russian railways. Increase in motor fuel supplies to the home market is also expected this year: programs for state support of the Russian rural sector will provide agricultural producers with fuels and lubricants at affordable prices.

- Production of the so-called “viscous oil” that used to be in a low demand by the market is now increasing in Russia. Gas and petrochemical businesses are also developing actively. Given the overall decrease in oil stock freight carriage, the transportation of gas and petrochemical products, superviscous oil and heavy bitumens as well as high-quality motor fuel are the most promising segments of the oil cargo railway transportation market.

Address of the President

Address of the President

175th Anniversary of Russian Railways

175th Anniversary of Russian Railways

Analysis

Analysis

Save Key Indicators to XLS

Save Key Indicators to XLS

Transport Development Strategy

Transport Development Strategy

Investment Activity

Investment Activity

Download Chapter Financial and Economic Performance

Download Chapter Financial and Economic Performance

Rating

Rating

Loan Portfolio

Loan Portfolio

Management System

Management System

Governing Structure Of JSC Russian Railways

Governing Structure Of JSC Russian Railways

Personnel management

Personnel management

Housing policy

Housing policy